[Subscribe to our Hotel Recovery data report –https://share.hsforms.com/1JUGWtIDBRhOSz-PhH3g-2g2yega ]

At last, we have a date – 17th May 2021. While we understand it is still “no earlier than”, and it will be at least full 14 months from the first stay at home message, at least now the hard work can start. Assured Hotels continue to offer independent support and impartial advice, from our unique position unincumbered by our own assets.

Thankfully with the health situation now improving to a sustainable position, backed by the vaccine program and other scientific progress we are quietly confident this will be our last period under these restrictive conditions. So we have taken the opportunity to look at a variety of initiatives we are adopting with at last a focus on sales, revenue growth and distribution.

It feels like a very long time since looking at sales strategies had any worth or benefit, and we accept that the forced economic downturn and behaviour changes will mean trading conditions will be very different to just 12 months ago. There will be some markets which will bounce back quickly, whereas some will be slow to return or will not deliver prior volumes at all, so we believe creativity through a refreshed approach will be crucial.

Revenue Management, Sales & Marketing refresh.

[Subscribe to our Hotel Recovery data report – https://share.hsforms.com/1JUGWtIDBRhOSz-PhH3g-2g2yega ]

From late March Assured Hotels will be issuing regular market reports and analysis to highlight pricing trends as demand grows, regionally on rooms sales. We will also include pricing data and access to key supply lines. Market data and wider intel is crucial for making good decisions in normal conditions, so with great uncertainty ahead the option to lean on regular & relevant 3rd party support will be a greater necessity if we are to understand and stay ahead of these shifting conditions.

AH partner with various 3rd party sales channels and routes to market, we are very confident that this combined expertise can provide workable solutions in the recovery period ahead. A major focus has to be on rooms pricing and market trends, as consumers will be more particular on how and where they book. We are confident that a positive from the pandemic will be the opportunity to reduce the OTA cost and their historical market share dominance – behaviour has changed as we will all continue to seek the assurance of safe practices from businesses we visit. This safety verification is much easier to communicate direct on own websites so a massive opportunity to capture those bookings, drive repeat loyalty through brand recognition and save on commissions.

Location specific strategies have therefore never been more relevant, with an expected significant bounce back in leisure locations from pent up stay-cation demand. Conversely town, city and airport locations reliant on business and travel dependent markets will need a different approach, particularly where international travel is a driver – we have set out a simple case study using data freely available from SiteMinder World Hotel Index below to give an initial flavour on this market and why some hotels will need to replace income.

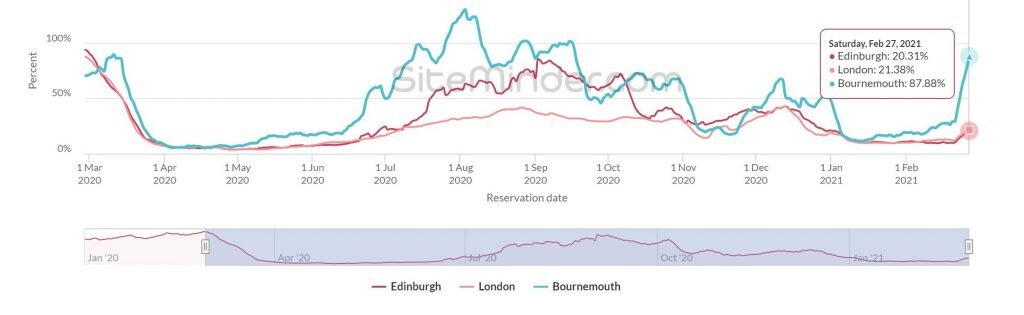

Booking Momentum by City – table below compares daily booking momentum as a % of year prior, taking three popular but very different destinations – Edinburgh, London & Bournemouth.

Observations: it seems incredible to say with confidence that London and other major cities will struggle to achieve 50% of pre-pandemic volumes, but with pressure set to remain on international travel and business markets that will likely play out to be the case, certainly in the next 6 months. As an indicative leisure dominant comparison Bournemouth fared well in summer 2020 and we can see booking momentum already lift into this February for 2021 season – as of 27th Feb Bournemouth is already at 90% of prior year compared to barely 20% in the other cities.

International travel markets tend to be booked longer lead than domestic leisure and contracted at known volumes or high ADR, or in some cases both, plus they are high incremental spenders on F&B and attractions. That makes this a difficult segment to replace like for like, so we are advocating a comprehensive business review, which could include:

- Leisure destinations – have rate strategies and routes to market been reviewed to capitalise from pent up demand and expected stay-cation boom from 17th May?

- Full-service hotels – is now the time to readdress the balance of facilities which may not be required, potential to improve conversion with reduced operating costs?

- City/ airport business hotels – is the business demand from a shift in behaviour and restrictions on international travel going to hinder recovery growth? Do hard decisions around rationalisation of a group to exit some assets or even look at property values for change of use?

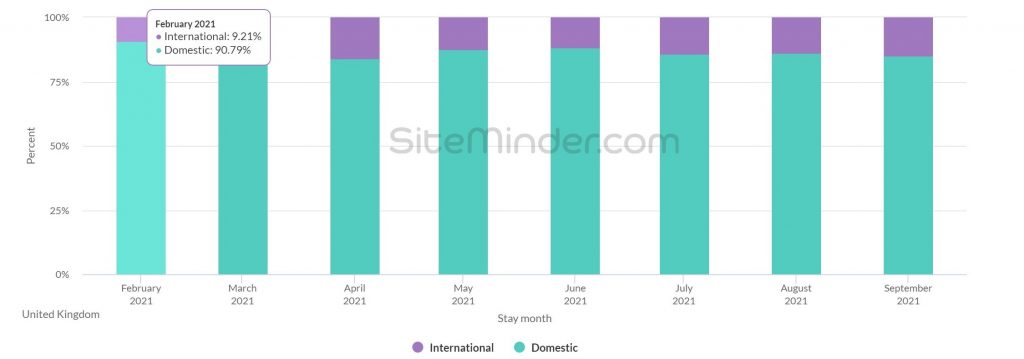

Forecast spring/ summer 2021 by international and domestic mix – makeup of domestic and international arrivals.

Observations: February 2021 shows just 10% of hotel arrivals will be international travellers, when the same month in 2020 was just over 23%. We must also consider that the new prohibitive quarantine rules have only just started, and for how long is a big unknown. We doubt therefore that the international mix will grow back towards the 20% of the suggested mix in the summer under those conditions.

This is a high-level example of the shift due to behavioural change driven by current Government quarantine policy, which will likely be in place for some time to come. With only a handful of countries mirroring the speed of the UK vaccine roll-out this could be for several months, potentially into 2022, so we need to understand how these evolving factors will influence each location and hotel type. This will need to include not only the income drivers and market mix, but also revised cost base to improve margins and therefore the serviceability of new funding levels.

[Subscribe to our Hotel Recovery data report – https://share.hsforms.com/1JUGWtIDBRhOSz-PhH3g-2g2yega ]

Sales Growth, Impact on Operational Structure

As we emerge most businesses will look very different to the ones we shut in spring 2020. During the past year Assured Hotels have gained valuable experience on options which achieve results in some very problematic scenarios. Even on some cases where values have fallen to the extent that funding levels mean stakeholders are underwater and recapitalisation or a reasonable exit price is not viable. Options we could discuss include:

- Recapitalisation & refinance options – AH track record of working with most of the financial institutions and other funders, allows us to independently support relationships and solutions between lender and operator, particularly where there are performance concerns.

- Light touch administration – an underused tool where management & directors can retain some control with the support of an insolvency process, for more details read this article by FRP Advisory on light-touch-administrations

- Property Guardians – secure your asset while mitigating costs over a period of at least 3 months by working with us and our partner Ad Hoc Property Management.

- Change of use – we have worked on cases where, in conjunction with Guardians in situ to buy time, land or asset value is higher than a going concern sale. We have trusted contacts in legal property teams to explore this option.

Over the months of the pandemic, we have worked on other asset value preservation initiatives, please see our website for other support during the remaining lockdown or planning ahead for the recovery phase.

Supporting Stakeholders – meet with us on a no obligation basis

In direct response to ongoing challenges faced by the hotel & hospitality sector Assured hotels will be offering no obligation meeting time to sector stakeholders.

We will be providing access to our senior team to discuss any challenges. We have made our significant experience and resources available without charge to cover all main disciplines of finance & forecasting, procurement, sales and revenue management, plus funding and government support access. We will endeavour to answer any question raised, so please click here to book a meeting email [email protected] or call 0203 205 7239.